By Richard (RJ) Eskow, cross-posted from Campaign for America's Future

Europe's in crisis. Unemployment is at a fifteen-year high after climbing for ten straight months, thanks to the austerity measures imposed on it by conservative leaders in France, Germany, and the international financial community.

But if you think things are bad over there, imagine what they'll be like if Republican budget measures are imposed here. The GOP budget makes European austerity look like summer camp.

Ever wonder why lemmings jump off cliffs?

While England Slept

Great Britain blazed the trail for Europe with a series of steep cuts to government spending - and it soon led the continent in economic misfortune. Unemployment skyrocketed, consumer confidence plummeted, and growth stagnated.

That's what austerity economics does to struggling economies. When you ask already-beleaguered middle class and lower-income people to bear the burden for the mistakes that made other rich the results are predictable: real income falls, demand for goods and services drops, and the entire economy drops back into a death spiral.

You'd think that Europe and the world would have learned from Britain's mistakes, but they haven't. In fact, even Britain hasn't learned from its mistakes. As the New York Times reports, the UK is doubling down on the madness.

In its latest round of budget announcements the government announced that it's continuing to push for additional spending reductions but wants to cut taxes for the wealthiest citizens, including those who got rich from the bank speculation that broke the economy! As critics have correctly observed, the UK government is paying for this rich person's tax cut through a 'stealth tax' on low-income retirees.

Britain's misplaced emphasis on reducing government deficits is even backfiring where deficits are concerned. From the Times: "The Office for National Statistics said Wednesday that Britain's budget deficit almost doubled in February, to £15.2 billion, far exceeding economists' expectations of about £8 billion. "

Kamikaze Europe

Now the rest of Europe is following Great Britain's lead. Unemployment is officially 10.8 percent and expected to reach 11 percent soon. Seventeen million people are out of work.

Austerity mania spread through Europe like a plague. Unemployment's now at 23.6 percent in Spain and 21 percent in Greece. How is a country expected to lower its deficits when a quarter of its working population isn't paying taxes and doesn't have disposable income? Apparently the financial geniuses running things there didn't think about that.

Ireland was once touted as austerity's success story. They're not bragging on Old Eire much now that it's officially back in a recession. Spain's problems disprove the theory that government debt is the source of all economic woes since, as Paul Krugman notes, Spain has been a much more thrifty government spender than Germany. Further austerity measures there are going to be disastrous.

Then there's Greece. According to reports, there are no working traffic lights left in the city of Athens. People have taken to bartering for goods and services in a world where many people have little or no sources of currency income while the streets swarm with formerly middle-class Greeks who are now being described as 'the new poor.'

In fact, there are encampments of the working poor throughout Europe. Even the leading European economy, Germany, is losing ground because of Chancellor Merkel's obsession with austerity measures - while France, the other austerity leader, is also struggling.

What do they plan to do, now that they have the benefit of experience? More austerity, according to reports. Merkel even thinks that's the road to her own re-election.

The Home Front

Which gets us to the United States. The Republicans in Congress have just passed a budget that makes Europe's austerity measures seem positively genteel. Rep. Paul Ryan, the Pied Piper of nihilist economics, said when it passed that we're in a "debt-driven crisis, and so we have an obligation -- not just a legal obligation but a moral obligation -- to do something about it."

That budget's "moral obligation" doesn't extend to our military budget, which the Republicans voted to massively expand - or to tax breaks for millionaires and billionaires, whose current historically low tax rates will plunge if their budget ever goes into effect. And, as we now know, the GOP budget would essentially shut down every other function of government that Americans have valued for the last century and a half. 62 percent would come from programs for lower-income people and Pell grants to help young people go to college.

And what a time for austerity: As Matt Stoller notes, one in seven Americans is being pursued by debt collectors. Student loan debt exceeded $1 trillion last year, even as young people face sky-high unemployment. 8.8 percent of student loans defaulted in their first two years of payment last year and more than one-fourth of student loan payments are now delinquent.

Robert Schiller, arguably the world's top economic expert on real estate, says that prices for suburban real estate aren't coming back in our lifetime. Consumer debt is soaring. US growth is expect to turn even more sluggish, which even has Ben Bernanke pushing for more government action.

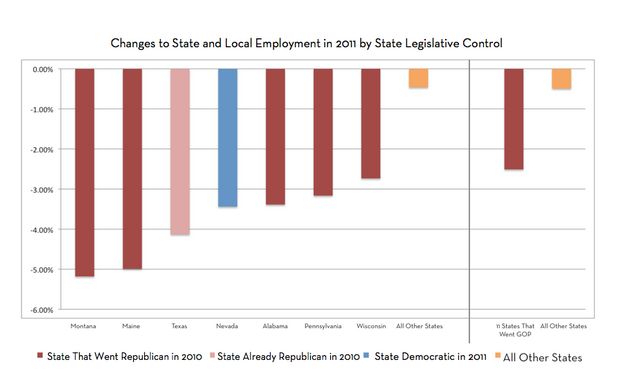

But while the projected deficit reductions in the GOP budget are a hoax, the cuts to vital programs, including its hidden cuts to Medicare, aren't. As Mike Konczal notes, states like Florida are a preview of a Ryan-budget America. Konczal coauthored an article with Bryce Covert which showed that "Of the eleven states in which Republicans came into power in 2010 -(five) lost more than 2.5 percent of their workforce from December 2010 to December 2011."

Bargain Basement

The budget-cutting rhetoric of the right is too often echoed by Democrats, at a time when they (or someone) should be proposing a more common-sense and more humane approach to the economy. Talking about deficits today is the moral equivalent of lecturing firefighters about water conservation while the town is burning down.

We need to put out the fire first. We urgently need spending to create jobs, especially when the government can borrow money for virtually nothing. Or, to put it another way -

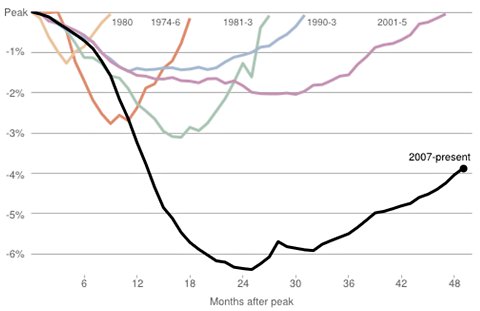

This is your country:

(employment, United States)

This is your country on austerity:

(Konczal, Covert)

And yet there are still those in the White House and Congress who dream of a "grand bargain" with the Republicans, like the one the President nearly finalized last year - a bargain that would send the nation's economy over a cliff.

Lemmings

People used to believe that lemmings committed mass suicide. Scientists now say that they're following migration patterns which sometimes lead them straight into the ocean. Either way, a lot of them drown because they followed the tail of the rodent in front of them.

The US seems determined to cling to Europe's ragged tail as it plunges into the icy waters below. The Republicans would drown our economy in a way that would make Europe's problems seem mild by comparison. (At least they still have working governments over there.) But few Democrats are willing to challenge the austerity fundamentalism that's gripped Washington. Instead they prefer to debate means to an austere end, rather than the end itself.

It's all insane. But this Ryan budget - now the official budget of Republicans in Congress, and warmly embraced by presumptive GOP candidate Mitt Romney - is the biggest sign of insanity yet.

Not that our national leaders are lemmings. Far from it. They're intelligent economic actors behaving in a way that ensures they'll receive future rewards. That means if we don't like the way this story ends, we'll have to change it ourselves.

No, politicians aren't the lemmings in this story. Until the time comes when we demand something different from our leaders in Washington ...... we are.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.